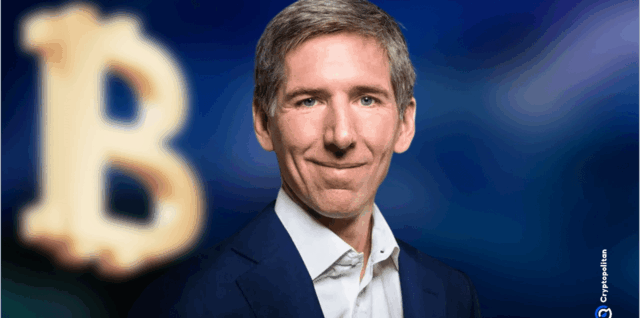

The post Bitwise CIO warns of retail capitulation while institutional demand for Bitcoin persists appeared on BitcoinEthereumNews.com. Bitcoin is now trading below $100,000, dipping to its lowest level since June, and the panic button has already been slammed by most retail investors. Leverage trades have collapsed, sentiment is wrecked, and what’s left looks a lot like a crypto winter. But Matt Hougan, chief investment officer at Bitwise, isn’t flinching. He sees this brutal selloff as the exact setup that could end with Bitcoin hitting a new all-time high before the year is out. Speaking Tuesday on CNBC, Matt said, “It’s almost a tale of two markets. Crypto retail is in max desperation. We’ve seen leverage blowouts … the market for sort of crypto native retail is just more depressed than I’ve ever seen it.” For him, that desperation is a bottom signal. While retail is pulling the plug, Matt says institutions are still very much in the game, and they’re not scared. He said that financial advisors and Wall Street firms he speaks with are still eager to gain exposure to Bitcoin, even with the recent pullback. “When I go out and speak to institutions or financial advisors, they’re still excited to allocate to an asset class that if you pan back and look over the course of a year, is still delivering very strong returns,” Matt said. Institutional appetite holds strong despite crash The big players aren’t retreating. While ETFs tied to Bitcoin have seen slower inflows since Q2, the money hasn’t stopped. Matt pointed to continued strength in vehicles like iShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), and the Grayscale Bitcoin Trust (GBTC). All three are still pulling capital. In his words, “We continue to see strong inflows into bitcoin.” Matt also mentioned Bitwise’s own Solana staking ETF (BSOL), which pulled in over $400 million in its first week. That enthusiasm took… Continue reading Bitwise CIO warns of retail capitulation while institutional demand for Bitcoin persists→