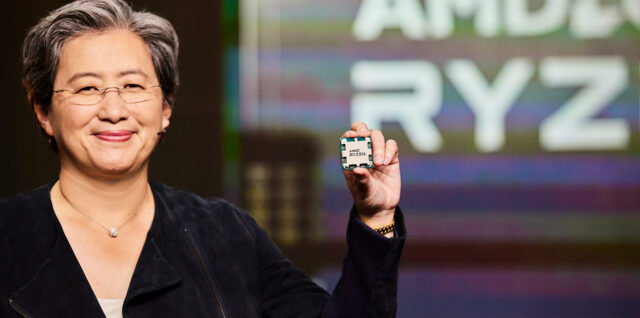

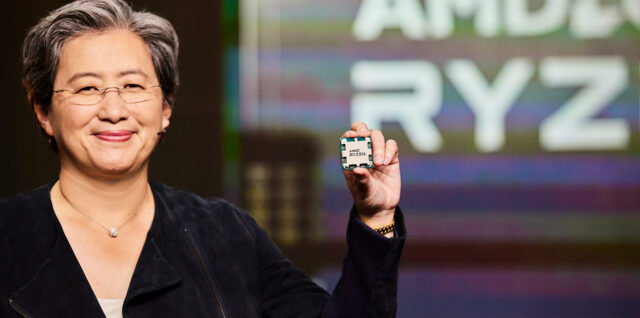

Listen to the AMD Q3 2025 earnings call here

Listen to the AMD Q3 2025 earnings call here Continue reading Listen to the AMD Q3 2025 earnings call here

Listen to the AMD Q3 2025 earnings call here Continue reading Listen to the AMD Q3 2025 earnings call here

The post Binance Founder CZ Crashed the Altcoin with a Single Tweet Which He Had Previously Caused to Rise com. The price of Giggle (GIGGLE), which Binance founder CZ recently mentioned and caused a sudden surge in price, has experienced a sharp drop in the last 24 hours. According to data, the token briefly surpassed the $110 level before falling below $70. Currently trading at $66. 43, GIGGLE has lost over 25% of its value in the last 24 hours. Chart showing today’s volatility in GIGGLE price. The decline is thought to be related to a recent statement from Binance founder Changpeng Zhao. CZ stated, “The Giggle token has not been officially issued by Giggle Academy,” indicating that the project has no direct affiliation with them. CZ also addressed reports that Binance would donate 50% of Giggle Fund trading fees to charity, saying he was pleased with these donations but didn’t know who issued the token. Zhao said he wasn’t surprised by Binance’s donation of the trading fees. Binance recently decided to list this altcoin after CZ mentioned GIGGLE. *This is not investment advice. account now for exclusive news, analytics and on-chain data! Source:. Continue reading Binance Founder CZ Crashed the Altcoin with a Single Tweet , Which He Had Previously Caused to Rise in Price

HTX Wins “Web3 Venture Capital Fund of the Year” Award at Blockchain Life 2025 Continue reading HTX Wins “Web3 Venture Capital Fund of the Year” Award at Blockchain Life 2025

Sen. John Fetterman (D-Pa.) on Friday criticized his fellow Democrats for repeatedly voting against legislation to reopen the government — a move that has put aid programs such as the Supplemental Nutrition Assistance Program (SNAP) at risk. Democrats have held firm to their demands for an extension of health care subsidies under the Affordable Care… Continue reading Fetterman leans on fellow Dems to reopen government: ‘This is not some sh—y game show’

TLDR AMTD Digital Inc. (NYSE: HKD) reported revenue of $73. 2 million for the six months ended April 30, 2025, representing a 1, 085. 9% increase from $6. 2 million in the same period last year. The revenue growth came primarily from the consolidation of The Generation Essentials Group as a subsidiary since October 2024, which boosted the media and [.] The post AMTD Digital (HKD) Stock: Revenue Explodes Past 1, 000% in First Half Results appeared first on CoinCentral. Continue reading AMTD Digital (HKD) Stock: Revenue Explodes Past 1,000% in First Half Results

Government shutdown eliminates Affordable Care Act tax credits and SNAP benefits, leaving millions without health benefits or food assistance as Congress fails to act. Continue reading Washington dysfunction is ruining the lives of millions of ordinary Americans

Fortified Funds & Fast Payouts: A Deep Dive jackbit Casino Review & Comprehensive Crypto Betting Platform. A Deep Dive into Game Selection Cryptocurrency Compatibility and Transaction Speed The Jackbit Casino Club: A VIP Rakeback System Sportsbook Functionality & Betting Markets Customer Support and Overall User Experience Fortified Funds & Fast Payouts: A Deep Dive jackbit. The post Fortified Funds & Fast Payouts A Deep Dive jackbit Casino Review & Comprehensive Crypto Betting Plat appeared first on Cryptoverze. Continue reading Fortified Funds & Fast Payouts A Deep Dive jackbit Casino Review & Comprehensive Crypto Betting Plat

TLDR: Netflix FLX announced a 10-for-1 stock split effective Nov. 17. Shareholders of record on Nov. 10 will receive nine new shares per share held. Stock rose 2% after hours and is up 42% in 2025. Split aims to make shares more accessible for employees and retail investors. Fundamentals remain unchanged; total value per investor [.] The post Netflix (NFLX) Stock Jumps as Streaming Giant Announces 10-for-1 Split appeared first on CoinCentral. Continue reading Netflix (NFLX) Stock Jumps as Streaming Giant Announces 10-for-1 Split

We’re thrilled to announce that BOS is available for trading on Kraken! Funding and trading BOS trading is live as of October 29, 2025. To add an asset to your Kraken account, navigate to Funding, select the asset you’re after, and hit ‘Deposit’. Make sure to deposit your tokens into networks supported by Kraken. Deposits [.] The post BOS is available for trading! appeared first on Kraken Blog. Continue reading BOS is available for trading!

Enphase Energy: Weak Outlook Likely To Keep Shares In The Penalty Box – Hold Continue reading Enphase Energy: Weak Outlook Likely To Keep Shares In The Penalty Box – Hold