**What Caused the Recent Toncoin Price Drop?**

Toncoin, the native token of The Open Network, experienced a significant decline amid regulatory scrutiny from Nasdaq directed at TON Strategy Co. The exchange issued a warning letter after the firm failed to obtain necessary shareholder approvals for a private investment in public equity (PIPE) transaction and subsequent Toncoin acquisitions. This development, announced in late 2025, triggered immediate market panic, with Toncoin’s price plunging 9.76% to a low of $1.918.

Institutional investors, who had shown strong interest in large-cap tokens like TON throughout 2025, reacted swiftly to the news, amplifying the sell-off via heavier exchange deposits. TON Strategy Co., positioned as a key institutional player, had aggressively accumulated Toncoin as a treasury asset. However, the lack of proper approvals raised concerns over governance and compliance, prompting Nasdaq to intervene—though it stopped short of pursuing delisting.

This event underscores the growing regulatory oversight on crypto-related corporate activities, even as demand for tokens like TON remains robust among institutions.

—

**How Are On-Chain Metrics Influencing Toncoin’s Current Trend?**

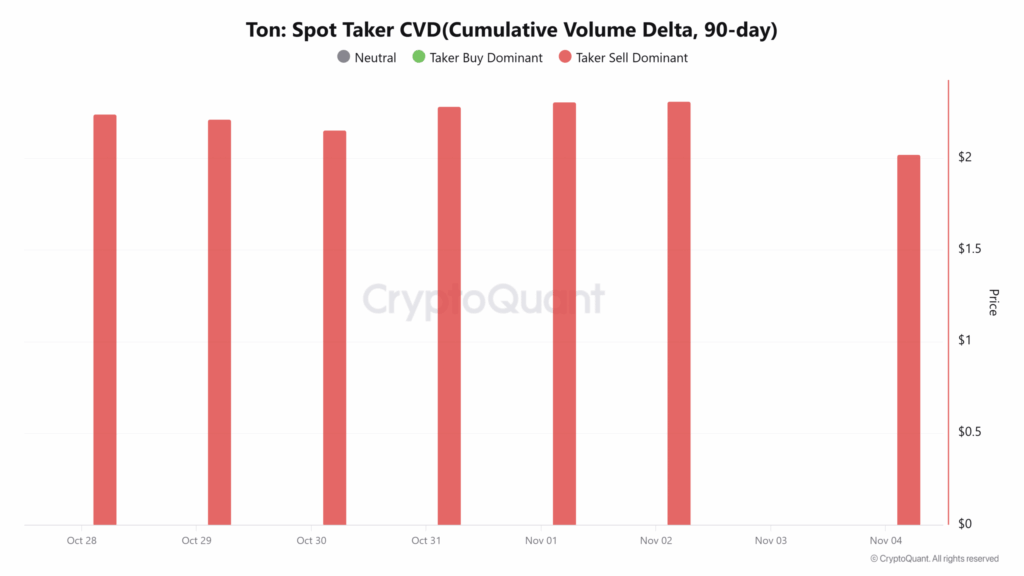

Market data from on-chain analytics platforms revealed telling signs of distress. The Spot Taker Cumulative Volume Delta (CVD) flipped negative, signaling a week-long dominance by sellers. Concurrently, spot netflows turned positive at $2.47 million, a metric often associated with tokens being moved to exchanges for liquidation.

Historical patterns indicate that such spikes in netflows have previously accelerated downside momentum for Toncoin. According to CryptoQuant data, the Spot Taker CVD has extended into negative territory, reflecting sustained seller control over the past seven days. This metric measures the net volume difference between takers and makers in spot markets, and its negative turn often precedes further corrections in volatile assets like TON.

In crypto markets, positive netflows typically signal potential selling intent from holders looking to capitalize on liquidity. For Toncoin, similar inflows during mid-2025 corrections correlated with price drops of up to 15%, based on aggregated on-chain data from multiple analytics firms.

“When institutional warnings coincide with on-chain sell signals, it creates a perfect storm for short-term bearish moves,” observed a senior analyst from a leading crypto research group.

These factors have positioned Toncoin for potential continued volatility, with traders monitoring exchange balances closely for signs of exhaustion in selling.

—

**Nasdaq Issues a Warning to TON Strategy Co.**

The catalyst for Toncoin’s price drop stems directly from Nasdaq’s formal notice to TON Strategy Co., an institutional investor deeply engaged in crypto treasury management. In August 2025, the firm executed a PIPE deal, selling $558 million in shares to private investors to fund Toncoin acquisitions totaling $273 million.

PIPE transactions allow companies to raise capital swiftly without immediate public disclosure but require subsequent shareholder ratification to comply with listing rules. Nasdaq’s review found that TON Strategy Co. bypassed these approvals, proceeding with the purchases despite internal awareness of the oversight.

Documents from Nasdaq, as detailed in regulatory filings, show that the funds were deployed into Toncoin holdings, reflecting the token’s appeal as a high-growth asset amid 2025’s institutional crypto surge. However, Nasdaq emphasized that the infraction appeared unintentional, citing no evidence of deliberate evasion.

Rather than escalating to delisting proceedings—standard for repeated violations—Nasdaq issued a warning letter, giving the company a grace period to rectify governance practices. This leniency highlights the exchange’s balanced approach to emerging sectors like cryptocurrency integration in corporate treasuries.

TON Strategy Co. has since stated its commitment to full compliance; however, the incident eroded investor confidence, leading to widespread selling across Toncoin markets.

From a broader perspective, this event illustrates the regulatory tightrope crypto firms navigate in traditional finance ecosystems. As institutions allocate more funds to assets like TON—driven by its scalability on The Open Network—compliance failures can trigger outsized market reactions.

Data from institutional custody providers shows that Toncoin inflows from such players reached record levels in early 2025, making any setbacks particularly impactful.

—

**Toncoin: Price Reaction and Key Levels to Watch**

The market’s response to the Nasdaq warning was swift and severe, with Toncoin’s price breaching the $2.00 psychological barrier and sinking to $1.918. This 9.76% intraday drop marked a clear shift in sentiment from bullish institutional accumulation to defensive positioning, as traders offloaded positions to mitigate risk.

The Relative Strength Index (RSI) dipped to 33, approaching oversold levels that could signal a potential reversal if buying interest returns. Meanwhile, the Sequential Pattern Strength (SPS) indicator fell to -13, confirming persistent seller dominance without immediate signs of fatigue.

Looking ahead, Toncoin traders should watch $1.80 as immediate support; a break below this level might expose $1.60, aligning with longer-term moving averages. Conversely, a recovery above $2.00 could catalyze a push toward $2.30, where previous resistance zones lie.

Volume analysis from TradingView indicates that reclaiming $2.00 would require sustained inflows to counter current on-chain outflows.

In the context of 2025’s crypto landscape—where regulatory clarity remains a key theme—events like the Nasdaq warning to TON Strategy Co. remind investors of the interplay between traditional finance and digital assets.

As Toncoin navigates this pressure, its fundamentals—rooted in The Open Network’s adoption for payments and decentralized applications (dApps)—continue to support long-term optimism.

—

### Frequently Asked Questions

**What triggered the Nasdaq warning to TON Strategy Co. involving Toncoin?**

The warning arose from TON Strategy Co.’s failure to secure shareholder approval for a $558 million PIPE sale in August 2025 and the subsequent $273 million Toncoin purchase. Nasdaq viewed this as a compliance lapse but issued a warning instead of delisting, citing no intentional misconduct. This announcement sparked immediate market sell-offs for TON.

**How might Toncoin recover from this price slide due to on-chain signals?**

Toncoin could rebound if spot netflows reverse and CVD turns positive, drawing buyers back above $2.00. With RSI near oversold at 33, a stabilization around $1.80 support might precede an uptick toward $2.30—especially if institutional confidence in TON’s treasury role rebuilds amid 2025’s bull trends.

—

### Key Takeaways

– **Nasdaq Warning Impact:** TON Strategy Co.’s compliance failure led to a 9.76% Toncoin price drop, highlighting regulatory risks for crypto treasury strategies.

– **On-Chain Sell Pressure:** Negative Spot Taker CVD and $2.47 million netflows confirm heavy exchange inflows, accelerating downside momentum as seen in prior 2025 corrections.

– **Price Levels and Strategy:** Watch $1.80 for support or $2.00 for resistance; traders should monitor RSI and SPS indicators for reversal cues amid volatile market conditions.

—

### Conclusion

The Nasdaq warning to TON Strategy Co. spotlighted compliance challenges in crypto asset management and triggered a sharp sell-off in Toncoin. On-chain data corroborates intensified selling pressure, while key technical indicators suggest Toncoin may be near oversold conditions with potential for a short-term rebound.

As the crypto ecosystem continues to integrate with traditional financial regulations, investors and traders must stay vigilant of governance and market sentiment shifts that can rapidly influence asset prices. Toncoin’s underlying adoption on The Open Network remains a positive anchor, making it a token to watch for recovery alongside evolving regulatory frameworks in 2025 and beyond.

https://bitcoinethereumnews.com/tech/toncoin-may-test-1-80-support-amid-nasdaq-warning-and-sell-pressure/