**Taiwan Explores Building a National Bitcoin Reserve Using Seized BTC**

Taiwan’s Prime Minister and the Central Bank have agreed to study the possibility of establishing a national Bitcoin (BTC) reserve. The country aims to utilize seized BTC to build up its treasury, marking a significant step toward integrating cryptocurrency into official financial strategies.

The Taiwan BTC initiative was presented to the Premier and Central Bank with the goal of converting the nation’s store of seized Bitcoin into an official treasury asset. This proposal comes at a time when BTC prices have retreated from their all-time highs but still trade above $102,000.

### Proposal Details and Legislative Support

Legislator Dr. Ju-chun Ko spearheaded the treasury initiative. Dr. Ko proposed a pilot study alongside a six-month period to draft new crypto-friendly legislation. The proposal was developed in partnership with the JAN3 group, led by long-term Bitcoin advocate Samson Mow.

Dr. Ko has previously urged Taiwan’s Central Bank to consider alternative reserves amid growing economic and political uncertainties. The proposal highlights the recent volatility of the Taiwan dollar and suggests that BTC could serve as a hedge against such currency fluctuations.

### Taiwan’s Current Treasury Overview

Taiwan’s Central Bank currently holds approximately $600 billion in foreign currency reserves and 432 tonnes of gold, positioning it among the world’s largest treasuries. Notably, gold reserves increased in 2025 in response to geopolitical tensions.

However, the Central Bank has not yet treated Bitcoin as a comparable alternative to traditional reserves against currency debasement. Authorities remain cautious, especially after the rise in stablecoins, which prompted calls for stricter oversight on their usage and issuers.

Despite some skepticism from regulators, the Central Bank has agreed to launch a pilot study examining the use of seized BTC as part of its treasury management.

### Government Entities as Long-Term BTC Holders

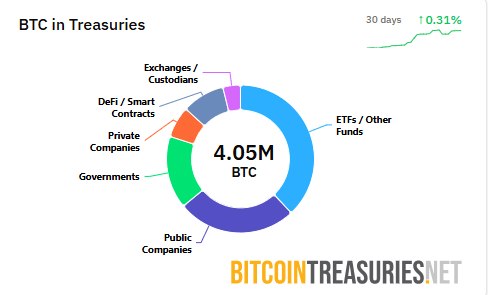

Globally, government entities hold an estimated 644,342 BTC, mostly accumulated through crypto-related seizures. Notable exceptions include countries like El Salvador and Bhutan, which have acquired Bitcoin through a combination of buying and mining operations.

These government holdings usually come at an extremely low cost basis, with little to no pressure to sell. However, some seized BTC remain contentious, and portions may be inaccessible despite the existence of court orders. Currently, there is no detailed data on BTC holdings controlled by Taiwan.

While China holds approximately 190,000 BTC, it does not officially treat the cryptocurrency as part of a deliberate reserve strategy.

### Shifts in BTC Ownership and Market Dynamics

Bitcoin’s ownership structure has evolved, with a growing share held by large-scale entities such as corporate and government treasuries. These entities continue to absorb coins, often without the intention of active trading.

Ownership has shifted from retail investors toward both long-term and short-term “whale” wallets. In 2025, whales took profits on some BTC holdings, but the presence of substantial corporate and government reserves helped prevent market panic and widespread capitulation.

With the rise in derivative trading, long-term holders have fewer incentives to sell their actual coins, reinforcing BTC’s perception as a long-term hedge against currency debasement.

—

If you’re reading this, you’re already ahead. Stay informed and ahead of the curve with our newsletter.

https://bitcoinethereumnews.com/bitcoin/taiwan-explores-launching-national-btc-reserve-with-confiscated-crypto/